Tax Brackets For Seniors 2025. For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $14,600 for single and for those who are married, filing separately; Income tax rates and bands.

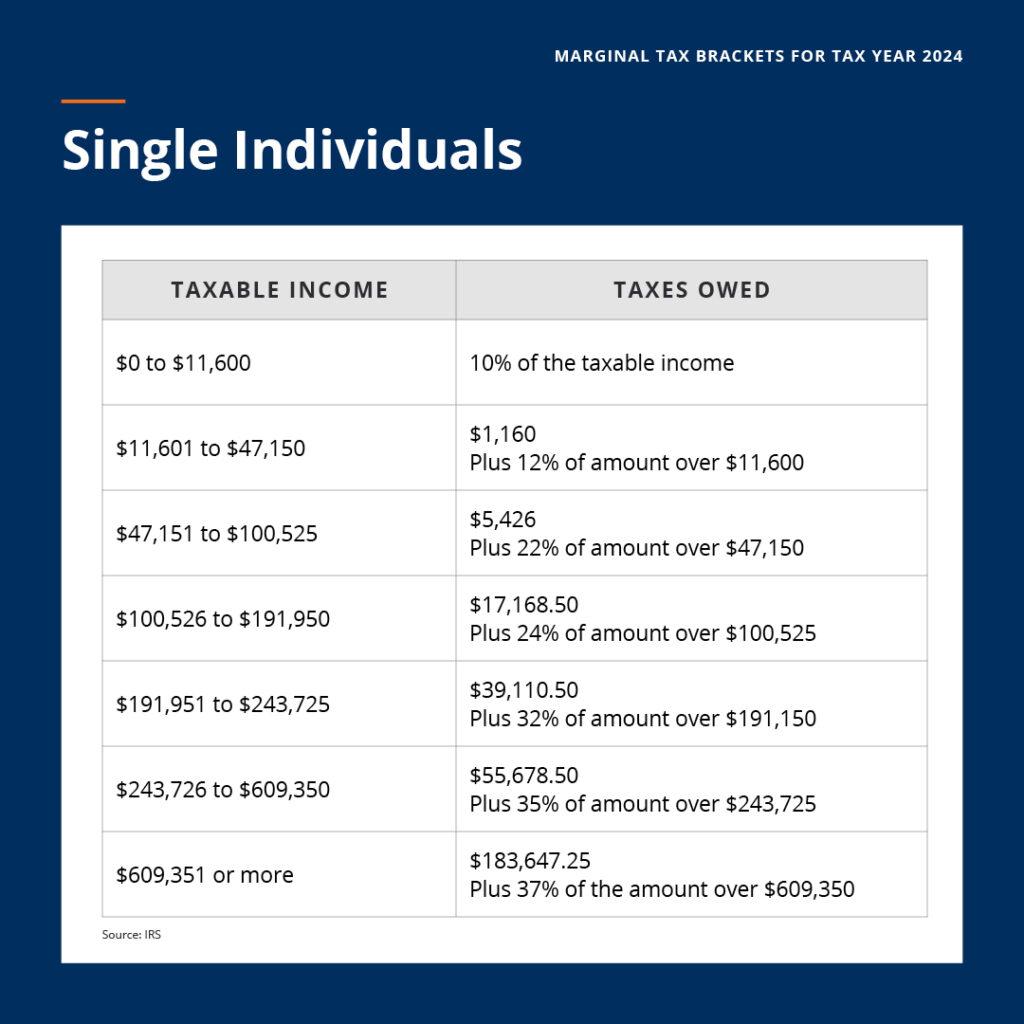

10%, 12%, 22%, 24%, 32%, and 35%. Let’s say for the 2025 tax year (filing in 2025), you earned a taxable income of $90,000, and you filed as single.

한계세율(Marginal Tax Rate) 100 정확히 이해하기, Irs releases income tax brackets for 2025.

2025 Tax Rates And Brackets For Seniors Vevay Theadora, Irs releases income tax brackets for 2025.

2025 Tax Brackets For Seniors Over 65 Timmy Giuditta, Using our federal tax brackets calculator.

2025 Tax Brackets For Seniors Over 65 Single Lonni Randene, The irs has adjusted federal income tax bracket ranges for the 2025 tax year to account for inflation.

How Many Leap Years Are There From 2025 To 2025 Tax Brackets2024, 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Senior Tax Brackets For 2025 Abbye Elspeth, The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

2025 Tax Brackets Here's Why Your Paycheck May Be Bigger This Year, This article looks at the details of tax brackets, exemptions, and deductions for this group.